Fees

ABOUT PRIVATE FEE PATIENTS

Our practice sees public and private patients.

Public patients can also be seen in public clinics at public hospitals, this will not attract a fee. Public patients seen in the private rooms will need to pay the consult fee, of which a porting can be rebated if a valid referral has been made.

Unfortunately there is very limited access to public bariatric surgery in NSW. We do offer the ability to have your bariatric operation in the private system. We can discuss this with you.

Dr Whitcher and Dr McQuillan work at the following private hospitals;

- Lake Macquarie Private Hospital

- Newcastle Private Hospital

- Lingard Hospital

- Maitland Private Hospital

- Hunter Valley Private Hospital

After discharge, your care and follow up appointments will be arranged to be with your surgeon. This will be done in the private rooms.

As a private patient our surgeons will perform your surgery personally, and will also look after you. All follow up appointments will be in our private rooms.

Overview of Payment for Patients

- the billing types our practice offers,

- the billing policies for our medical services, and

- further explanations to common fee questions patients have.

Types of Patients

Our practice treats the following types of private patients:

- Privately Insured Patients

- Insurance Patients (Workers Compensation, Motor Accidents etc)

- Veteran Affairs Patients

- Self funded Patients

Fee Estimates

We offer informed financial consent to all our patients prior to surgery. This is a pre-treatment estimate of your surgical costs.

While the fees charged may depend on the specific course of treatment, our practice's standard fees are in line with the Australian Medical Association (AMA) recommended fee schedule. This what the AMA recommends the cost of care should be. This means that in most instances there will be a ‘gap’ between our surgical fee and what is covered by Medicare and your health insurance fund.

The pre-treatment fee estimate includes the specific item numbers to be used and enables you to discuss with your health insurance company what you are covered for and if benefits are applicable.

If there is any problem with either the fee estimate or any other billing issue, it is important that you ask our staff. They can help you navigate what can be a complex process by either advising and helping explain the charges and rebate structure.

All Fee Categories

Our practice fees for either Consulting or Surgery may sometimes only be part of your treatment cost.

Other possible fees or disbursements involved in your care are dependant on which course of action is chosen for your treatment. You may need to also check with your health fund to see what is covered for additional areas of service. Potential fee categories to be sure of can include:

- Hospital Fees

- Surgical Assistant Fees

- Implants or Prosthesis Costs

- Anaesthetists Fees

- Diagnostic Tests (Radiology, Pathology)

- Post-Operative Care

Questions to Ask Your Health Fund

- What is my annual monetary benefit limit for:

- General Surgical treatment and Major Surgical treatment?

- What service limits apply to my cover?

- When does my annual benefit limit expire?

- Do I have a waiting period? And when does it end?

- What kind of Surgical treatment is NOT covered?

About Our Fee Policy?

The medical fee rebate system in Australia is complex. A set of fees for medical services is determined by the Federal Government and known as the Medicare Benefits Schedule (MBS). Most procedures involved in your treatment will have a MBS “item number” and the Government sets a Medicare Benefits Schedule (MBS) fee for each item number.

The MBS fee is used to work out how much Medicare will pay. Medicare pays a benefit of 75% of the MBS fee for in-hospital treatment and 85% of the MBS fee for out-of-hospital services. MBS fees are not the fees doctors charge, they are fees set by the government to manage the benefits paid by Medicare.

Surgeons are free to set their own fee for the services, these are also governed by the Competition and Consumer Act 2010 but are under no obligation to charge fees that are equal to the Medicare Benefits Schedule (MBS) fee or the schedules of medical benefits set by private health insurers.

Our fees not only take into account the professional fees but many other factors including practice staff, office expenses, operating expenses, medical registration, compulsory professional association subscriptions, professional indemnity insurance and many other elements. These cost can vary significantly, yet the Medicare rebates are identical irrespective of the practice running costs.

In our practice specialty, prompt communication with the referring general practitioners is vital, and prompt responses, with high staff levels is a major benefit to patient care, but also adds cost.

Surgeons should satisfy themselves in each individual case as to a fair and reasonable fee having regard to their own costs and the particular circumstances of the case and the patient.

The same operative procedure can vary enormously in both complexity and operating time between individual patients, and as such there may be significant variations in the operation fee for the same procedure, depending on the individual circumstances. For this reason sometimes it may not be possible for us to provide estimates for operative procedures over the phone prior to a clinical consultation.

Medicare Gap for Out Patient Services?

The Medicare Rebate for an outpatient service is 85% of the MBS schedule fee.

The “gap” between the amount charged and this 85% rebate is not covered by your private health insurance for outpatient services and therefore a financial obligation on yourself arises, and you will face an “out-of-pocket” charge.

As a patient you pay 15% of the MBS fee, plus any amount charged by the doctor over the MBS fee. Private health insurers are not allowed to provide cover for doctors’ fees for out-of-hospital services.

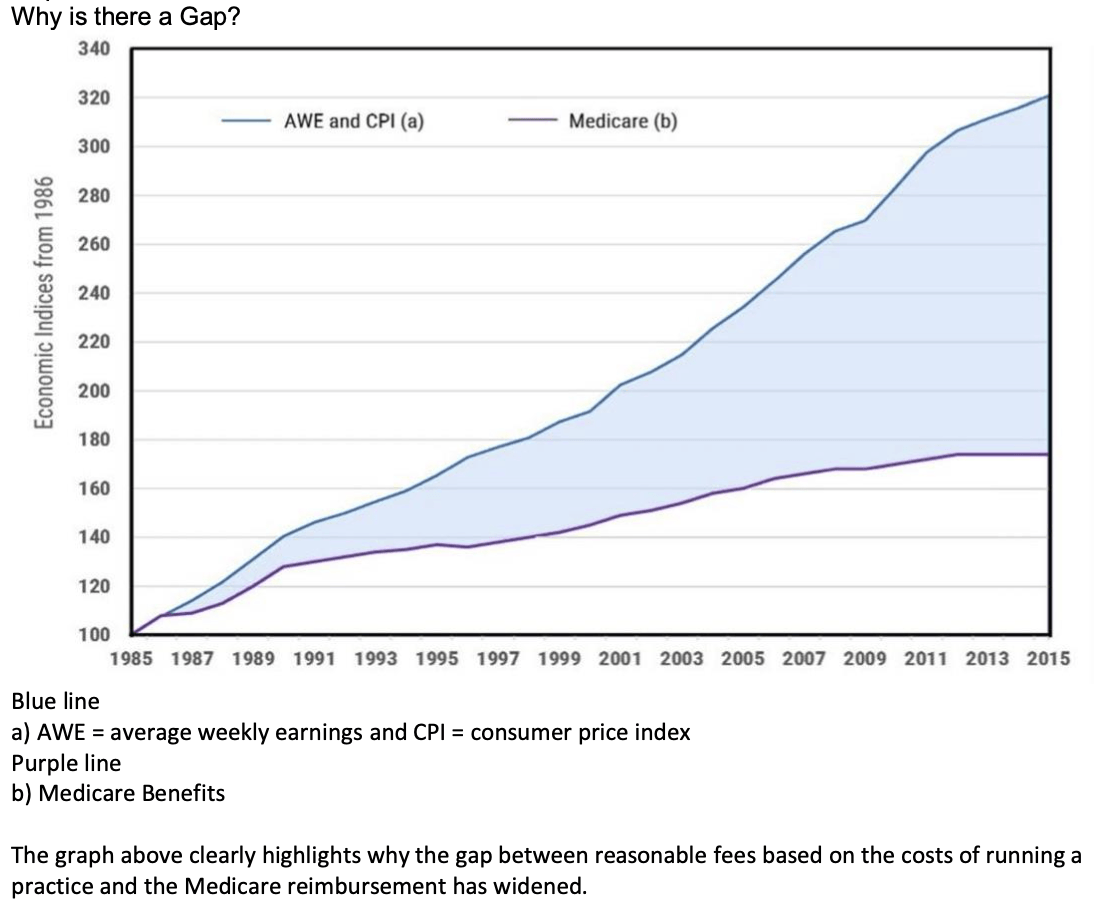

Medicare benefits levels are fixed by the federal government and benefit levels have not kept pace with inflation, the escalating costs of running a practice and increasing medical indemnity premiums, thereby widening the gap between reasonable fees and Medicare benefits.

The fees charged by our practice have been determined after careful study and investigation of practice costs and other relevant and material circumstances, and are considered as being fair, reasonable and appropriate for the services provided.

No Gap, Low Gap and Known Gap Policy

You have come across the following terms:

- No Gap

- Gap

- Known Gap

No Gap means there is an arrangement between your insurance company and the surgeon to do a particular procedure for a fixed fee. Similar to Medicare rebates, this often does not keep up with the costs of providing services. Our practice is not a no gap practice, however there may be procedures where there will not be any out-of-pocket expenses.

Gap surgeon will charge a gap based on the particular procedure. This can vary considerably as it is set by individual surgeons.

Known Gap is where the gap for a procedure will be known before hand, usually this will be a fixed fee.

We aim to provide a sustainable practice that is in line with what the AMA recommends. We do not charge beyond what they suggest (except in the case of bariatric services which entail specific follow-up requirements).

New Paragraph

Uninsured Public Patients

If you are not covered by private health insurance or other claiming system and your require surgery there are two alternatives:

- Go on a Waiting List at the Public Hospital, or

- Pay for the operation yourself ("Self Insure" "Self Fund")

In some instances, such a bariatric surgery, you may be able to access your superannuation early (early access under compassionate grounds progarm) in order to fund the surgery. Our team can discuss this with you.

Click here for the ATO website regarding early release of superannuation.

Australian residents who decide to be a public patient are entitled to free treatment under Medicare. Your treatment will be carried out by an appropriate specialist which will be arranged prior to your admission. After discharge, your care will either be continued in an outpatient clinic or you will be referred to your local general practitioner.

There are no fees for surgery in the public hospital, however, there is a waiting list. Your position on the waiting list will be based on the severity of your condition. Your follow up visits after surgery will be arranged through the hospital.

In the public hospital the surgery is usually performed by a registrar (doctor training) but the registrar is supervised by a senior surgeon who is responsible for your care.

Public Hospital Waiting List

Whilst we acknowledge that the public hospital wait list can be long, we will endevour to get your procedure done as soon as possible.